Hydrogen vs. Electric: Why Heavyweight Automakers Are Betting on Both

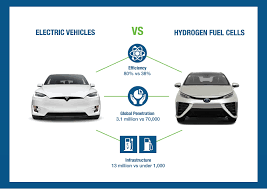

The future of clean transportation isn’t a single solution—it’s a dual-track race between battery electric vehicles (BEVs) and hydrogen fuel cell vehicles (FCEVs). While Tesla and BYD have gone all-in on batteries, legacy automakers like Toyota, Hyundai, BMW, and GM are hedging their bets by investing heavily in both technologies.

But why? Which one will dominate? And how are carmakers positioning themselves in this high-stakes energy showdown?

The Case for Battery Electric Vehicles (BEVs)

✅ Advantages:

✔ Widespread charging infrastructure (growing rapidly)

✔ Higher energy efficiency (70-90% vs. hydrogen’s 25-35%)

✔ Lower operating costs (electricity is cheaper than hydrogen)

✔ Faster adoption (millions of EVs already on roads)

⚠️ Challenges:

- Long charging times (vs. hydrogen’s 3-5 minute refuel)

- Battery weight & resource constraints (lithium, cobalt, nickel)

- Limited range for heavy-duty applications (trucks, ships, planes)

Big Players: Tesla, BYD, Rivian, Ford, Volkswagen

The Case for Hydrogen Fuel Cells (FCEVs)

✅ Advantages:

✔ Ultra-fast refueling (like gasoline, no long charging waits)

✔ Longer range for heavy vehicles (trucks, buses, trains)

✔ Lighter than batteries (critical for aviation & shipping)

✔ Cleaner lifecycle (if using green hydrogen)

⚠️ Challenges:

- Lack of infrastructure (few hydrogen stations globally)

- High production costs (green hydrogen is expensive)

- Lower efficiency (energy lost in conversion)

Big Players: Toyota, Hyundai, BMW, Honda, Daimler Truck

Why Automakers Are Investing in Both

1. Different Use Cases

- BEVs dominate passenger cars (daily commuting, urban driving).

- FCEVs may win in heavy transport (long-haul trucks, buses, industrial vehicles).

2. Regulatory & Geopolitical Pressures

- Europe & China are pushing hydrogen for industry and transport.

- Battery supply chains face mineral shortages; hydrogen could diversify energy sources.

3. Future-Proofing

No automaker wants to be caught on the wrong side of history. Toyota, for example, is:

- Selling BEVs (bZ4X, Lexus RZ)

- Pioneering hydrogen (Mirai, Hilux FCEV)

- Developing hydrogen combustion engines (Corolla H2 race car)

Who’s Betting on What?

| Automaker | BEV Strategy | Hydrogen Strategy |

|---|---|---|

| Toyota | bZ4X, Lexus RZ | Mirai, H2 engines |

| Hyundai | Ioniq 5/6/7 | Nexo, XCIENT trucks |

| BMW | i4, i7, Neue Klasse | iX5 Hydrogen pilot |

| GM | Ultium EVs | Hydrotec fuel cells (for trucks) |

| Tesla | All-in on BEVs | Skeptical of hydrogen |

The Verdict: Will One Win, or Will They Coexist?

- Short-term (2020s-2030s): BEVs lead for passenger cars; hydrogen grows in trucks, ships, and industry.

- Long-term (2040s+): Hydrogen could take off IF green hydrogen becomes cheap and infrastructure expands.

The smartest automakers aren’t picking sides—they’re preparing for both futures.

What Do You Think?

- Is hydrogen a viable alternative, or just a distraction from BEVs?

- Will trucks and planes go hydrogen while cars stay electric?

Drop your thoughts in the comments! ⚡🔥